Immigration support for your business — all through a single platform

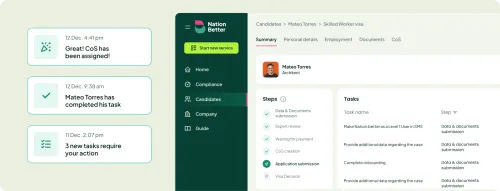

We understand that managing UK sponsorship is often overwhelming. Nation.better’s digital platform and expert guidance ensure a seamless, stress-free experience from start to finish